Image: © Alexander – stock.adobe.com

We’re a network of organizations and individuals dedicated to creating a nation that not only promises but delivers opportunities for all Americans to build wealth and live well.

LATEST

Keep up

Get NCRC news and alerts by email.

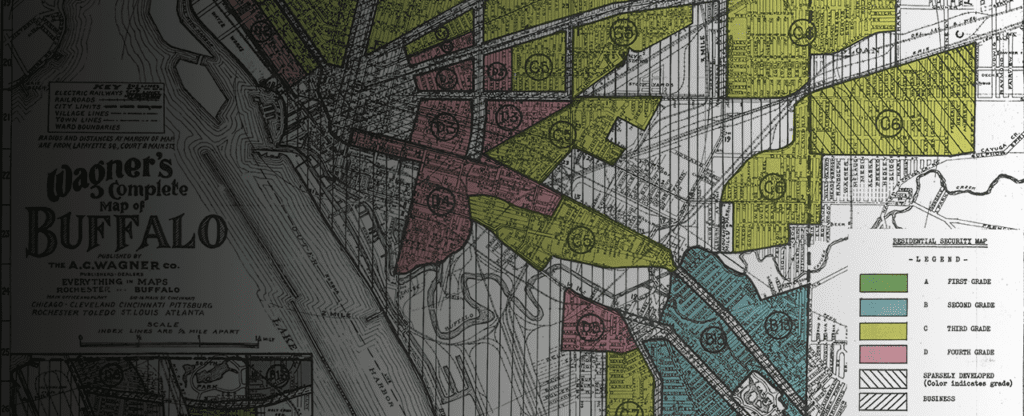

The Injustice Of Redlining

Better understand and undo the unfair burdens of structural racism, both past and present. Learn more.

Section 1071

Learn more about how the CFPB will collect small business loan data under the Dodd-Frank act. Learn more.

Office & Event Space

For nonprofits and social ventures, meet and work at the Just Economy Club in DC. Learn more.

We need your stories

Is there a project or issue in your community you want others to know about? Do you want to highlight an exceptional team member or person from your community?

Submit a form below so we can feature you in our Member Stories.