Key Findings

- 30% of mortgages in 2018 went to older adults.

- 67% of older adults who took out mortgages were refinancing their homes and 68% of those used the mortgage to access the equity in their homes.

- Older borrowers were Whiter than younger borrowers.

- As with younger borrowers, there are racial disparities in interest rates charged to minority and White older borrowers.

Introduction

For the first time, the Consumer Financial Protection Bureau released Home Mortgage Disclosure Act (HMDA) data inclusive of age. The 2018 data, released in September 2019, was the first to include the ages of applicants and co-applicants, offering insight on the activity of older adult borrowers.

Older adults play a critical role supporting the American mortgage market that COVID-19 has completely disrupted. While first time home buyers are often the focus in discussions about mortgage lending, it is older adults who refinance or take equity from their homes to finance retirement or aging in place that drive a third of US mortgages. Because of COVID-19, the primary ways they access that equity are in danger. This matters, and will have consequences that last far longer than the COVID-19 crisis itself.

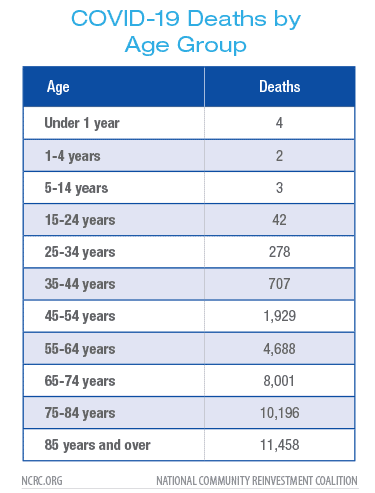

As COVID-19 brought the world economy to a standstill beginning in March 2020, infecting over 3 million people as of this writing, one salient point about those people the virus infects and kills is that they are overwhelmingly older than most of the population.

In the United States, 90% of the current deaths caused by this virus are people over the age of 55. These older adults face a dual threat as a result of COVID-19, first the virus itself and second, being especially susceptible to the economic fallout from the complete shuttering of the economy. Many older adults maintain their livelihood on fixed incomes. Many depend solely on Social Security resources to sustain daily expenses. With the potential of increased health care spending, specifically out-of-pocket Medicare expenses, as well as other financial shocks associated with COVID-19, the availability of mortgage credit to older adults is of utmost importance.

For the first time, the Consumer Financial Protection Bureau released Home Mortgage Disclosure Act (HMDA) data inclusive of age. Homeownership is the achievement of the American Dream, usually alluding to young couples establishing roots in a community. Homebuying can be a significant driver of wealth generation. The image of homebuyers is changing as the age of first time homebuyers is now 33 years of age and the average age of homebuyers is 47 years old, which is a steady increase over recent years as older adults are increasingly becoming first time homebuyers. While selling a home later in life may not always result in higher values and sales prices, various data and metrics point to the relationship of increased wealth and homeownership.

Most seniors who are homeowners own their home outright, as homeownership tends to rise with age and accumulated wealth. Seniors in that situation generally choose to age in place, may also consider downsizing or may move farther away to be closer to family and caregivers as they age. The need for universal design features and transportation challenges in suburban and rural communities may propel seniors to purchase homes elsewhere with increased accessibility. Multigenerational housing is an emerging trend across the country, as older adults, children and grandchildren opt to live under one roof for a myriad of reasons that may be cultural, social and economical in nature.

Mortgage data shows older adults are taking loans to buy and refinance homes in large numbers.

For most seniors, planning for retirement, aging in place or downsizing requires funding. This can be to modify an existing property to meet their needs as they age or to buy a new property that is more appropriate to that stage of their life. Nationally, older Americans account for 30% of mortgages in 2018, but this varied greatly across the U.S. As the map shows, in some states the role of older borrowers is much larger than in others.

Seniors overwhelmingly look for ways to use their equity

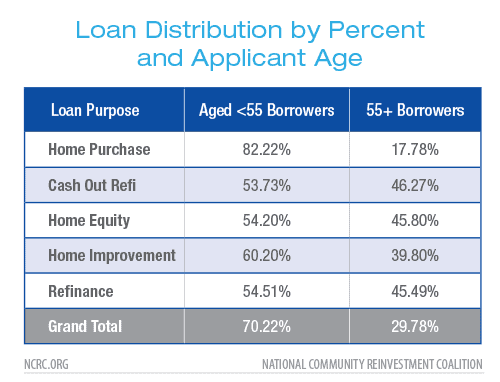

Older Americans were more likely to take out a refinance loan, likely to facilitate aging in place. Just 18% of home purchase borrowers in 2018 were aged 55 or older. Among the 2 million seniors that borrowed, NCRC found that in 2018 67% of older borrowers were taking refinance or home equity loans against homes they already owned. Over 68% of those borrowers were extracting equity from their homes, either through a cash out refinance or a home equity loan. Many older adults are house rich, but cash poor in an economy where significant expenses to that population, such as health care costs, steadily increase each year while income remains fixed. Tapping home equity allows cash poor, house rich older adults to plan for and afford needed home repairs, home modifications to increase accessibility and meet financial gaps, potentially related to increased health care spending.

States by percent of loans to people 55+ years old

Hover over each states for more data. Use the drop down menu in the upper left to change the type of loan represented by the map.

Source: 2018 HMDA Data

The Great Recession of 2007-2009 placed enormous strain on older homeowners, by the end of 2007 over 50,000 homeowners over the age of 50 were in foreclosure and nearly 636,000 were underwater on their mortgages. In 2007, 28% of all mortgage payment delinquencies were on mortgages to people over the age of 50. As of 2009, 67% of homeowners over the age of 65 with a mortgage were considered housing burdened. For low-income seniors with a mortgage, that figure was 96%. For seniors on fixed incomes with a mortgage, the cost of maintaining their homes is often a substantial burden, and leads to unenviable choices between paying the mortgage and affording basic necessities or repairs.

The population of older Americans is also not homogenous, with different age cohorts seeing varying degrees of income and wealth based on a variety of variables, according to the Federal Reserve Bank of St. Louis. In 2013, the St Louis Federal Reserve’s research found that older Americans born before 1950 had significant advantages in long-term income, wealth accumulation and economic prosperity.

The Dodd-Frank Act of 2010 required that the data collected under the Home Mortgage Disclosure Act be updated to include new data on topics such as the price of the loan offered to borrowers, the applicant and co-applicant age, racial sub-group data and if the mortgage is a reverse mortgage. These new variables collected in 2018 shed light on the kinds of loans and terms being offered to older adults in a new way.

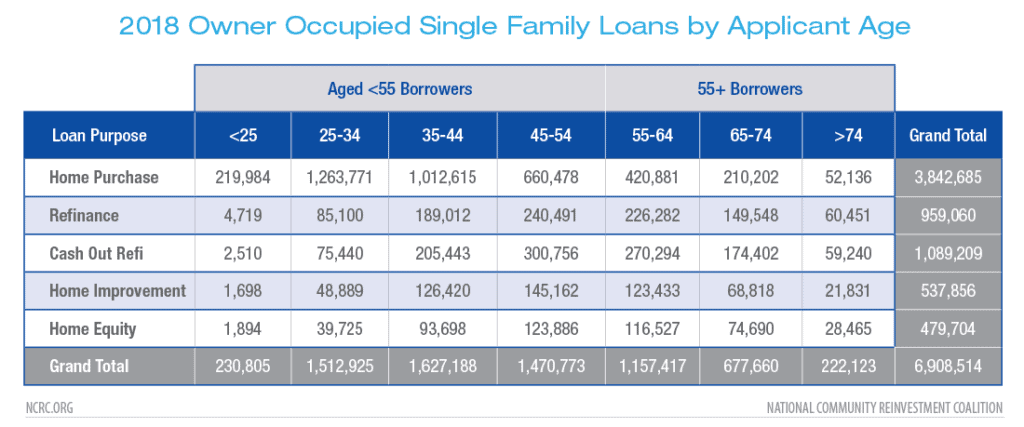

In 2018, there were 6.9 million loans made on owner occupied homes, with just over 2 million of those made to an applicant aged 55 or older.

Nationally, older adults account for 30% of mortgages in 2018, but this varied greatly across the U.S.

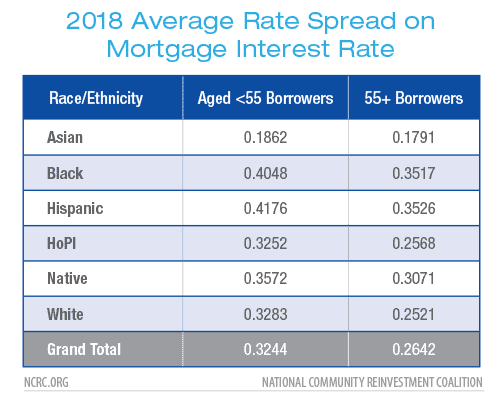

Older Americans are more likely to be White than members of younger age groups, this and structural differences that have long prevented people of color from buying a home make it even more likely that older loan applicants are White as well. In 2018, 73% of borrowers over the age of 55 were White, compared to 65% of younger borrowers.

The reason older borrowers seek a mortgage differs to that of younger borrowers, however. While applicants under the age of 55 sought home purchase loans 65% of the time, older borrowers did so in just 33% of cases. This pattern holds for every racial group with the exception of Native Hawaiian or Pacific Islanders, where just 25% of borrowers were purchasing a home. Most older borrowers were seeking cash out refinance loans, home improvement or home equity loans.

Older borrowers tend to pay less for their mortgages as well. The rate spread is the amount that the interest rate on a loan differs from the average interest rate charged nationally on the day of closing. However, there are consistent variations in the rate spread by race, with older adults showing the same higher cost of lending as younger borrowers of the same race.

Perhaps in part due to this less economically secure cohort of ‘younger’ older adults there has been a sharp rise in mortgage debt among this population. In 2018, the Center for Retirement Research at Boston College found that between 1984 and 2015 there was a 24% increase in the number of Americans over the age of 60 that were paying a mortgage, a figure that could not be explained by rising homeownership or other variables. Those with higher incomes or wealth may opt to focus on building retirement income, therefore taking on mortgage debt while rates are low. How these borrowers fair in a post-COVID recovery is complicated by their source of income. Those who rely on income from work, rental properties or certain investments will be under particular pressure as those sources of income are affected by the recession that most economists expect.

In their study on the impact of the Great Recession on older women and their ability to pay their mortgages, Amy Castro Baker and Stacia West found that race and gender as well as relationship status were correlated with greater difficulty in paying their mortgage. About one-third of mortgages made in 2018 to borrowers over the age of 55 were made to women. While the life expectancy gap is shrinking, women tend to live longer than men, a trend that may impact their ability to sustain mortgages, maintain housing structures and afford higher daily living costs, including increased medical spending.

Reverse Mortgages, a small market with a big impact.

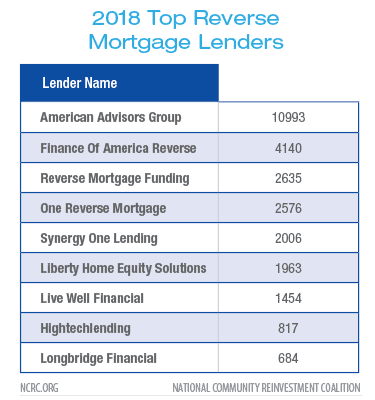

A Home Equity Conversion Mortgage (HECM), or reverse mortgage, is also an option for seniors who perhaps cannot meet income requirements for regular mortgages (some seniors may be living on a fixed income of retirement accounts/pensions or social security, for example). Or seniors may own a home without any remainder payments to the mortgage and wish to use the sale as a way to increase monthly payments to help meet demanding day-to-day costs, such as health care expenses or home repairs. A HECM enables an older adult or couple to withdraw some of the equity in the home in an amount that is fixed, a line of credit or both for the remainder of their lives to offset the increased costs of aging. This program is dominated by a small handful of specialist lenders and is relatively rare compared with the traditional forward mortgage market.

Home Mortgage Disclosure Data is Good for Older Adults

The addition of age to the 2018 HMDA data releases offers a snapshot assessment of mortgages and borrowing in 2018 by age and a new means of understanding senior homeownership, financing and wealth. With subsequent years of data collection, we can gleam a longitudinal assessment of home mortgages amongst seniors and younger populations. The next HMDA release, of 2019 data, is expected in the late summer or early fall of 2020. Perhaps even more interesting is looking ahead and considering the impact of the 2020 COVID-19 pandemic on U.S. mortgages and the economy.

Aging in place remains the primary goal for most older adults, and the data shows that they are using their homes to fund this process. Looking to 2020 data, the prevalence of COVID-19 in institutional settings such as assisted living and nursing homes may further encourage older adults to remain in their home as long as possible, utilizing home equity to do so.

The Federal Reserve provided emergency rate cuts in early March 2020 aimed to steady the economy as the global pandemic would likely provide a shock. Lower rates may propel some older adults to purchase or refinance in 2020, but with the market seeing a drop in supply, the demand among potential homebuyers may also decline. At this point during the pandemic, it is difficult to determine. Refinancing to a lower rate may be an enticing opportunity for older adults with mortgages, allowing them the ability to save for retirement and later life stage expenses. Given the lag in public release of HMDA data, we will not have a HMDA assessment of the effect of COVID-19 until 2020 data is released in 2021.